Page 16 - Hafen Hamburg | Port of Hamburg Magazine 4.2021

P. 16

■ WORLD TRADE

erbe hat weltweite ereits im es Jahres niert die

olkswirt- die in der fweisen. nicht nur nahmen ektionen gen der (Schutz- , von der hatten, den fort- ndustrie- induziert. wer, dem produkte rentable

nkender rfte noch eller von ie höhere etwa bei sich hin- e wieder

Die überraschend kräftige Nachfrage hat die Rohstoffpreise stark ansteigen lassen, zumal sie zeitweise auf ein reduziertes Angebot traf. Der HWWI-Index für Rohstoffpreise hat sich seit dem Frühjahr 2020 mehr als verdoppelt. Bei einigen Roh- stoffen haben sich zwar mittlerweile deutliche Preiskorrekturen

ergeben. Insbesondere bei einigen Industrierohstoffen dürfte

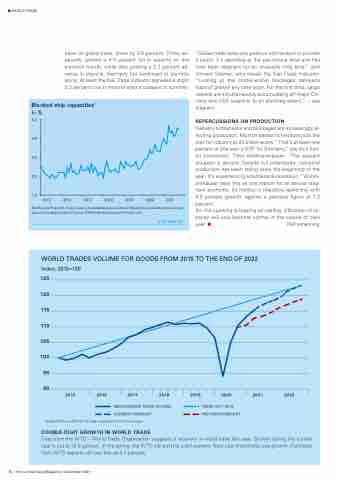

“Global trade lacks any positive momentum to provide a boost. It’s dawdling at the pre-corona level and has now been stagnant for an unusually long time,” said Vincent Stamer, who heads the Kiel Trade Indicator. “Looking at the containership blockages dampens hope of growth any time soon. For the first time, cargo vessels are simultaneously accumulating off major Chi- nese and USA seaports to an alarming extent,” – see diagram.

REPERCUSSIONS ON PRODUCTION

Delivery bottlenecks and blockages are increasingly af- fecting production. Munich-based ifo Institute puts the loss for industry at 40 billion euros. “That’s at least one percent of one year’s GDP for Germany,” say ifo’s Sen- ior Economist, Timo Wollmershäuser. “The present situation is absurd: Despite full orderbooks, industrial production has been falling since the beginning of the year. It’s experiencing a bottleneck-recession.“ Wollm- ershäuser sees this as one reason for an almost stag- nant economy. ifo Institut is therefore reckoning with 0.5 percent growth, against a previous figure of 1.3 percent.

So, the upswing is keeping us waiting. Utilization of ca- pacity will only become normal in the course of next year. ■ Ralf Johanning

tober on global trade, down by 0.6 percent. China, es-

das Preisniveau aber sehr hoch bleiben und möglicher-

pecially, posted a 4.9 percent fall in exports on the

weise noch steigen (vgl. Fokusthema: Hohe Rohstoffpreise).

Abbildung 1.3

previous month, while also posting a 2.7 percent ad- vance in exports. Germany too continued to stumble along.AtleasttheKielTradeIndicatorsignalledaslight 0.2 percent rise in imports after a collapse in summer.

Blocked ship capacities1

Blockierte Schiffskapazität1

In %

5,0

4,0

3,0

2,0

1,0

2015 2016

2017 2018

2019 2020 2021

11Montahtslydadtaetna::APnrtoepilodretrioFnraocfhctkarpgaozictäatpdaecritwyeilntwweioterlndCwoindteaidneerspeseescahicffofanhtarti,ndeiresbheilpapdiengistth,atbiesrloniacdhteudnbteurtwneogts.on the move

Sources: Calculations by Vincent Stamer of IfW Kiel based on data from Fleetmon.com.

Quelle: Berechnungen von Vincent Stamer (IfW Kiel) mit Daten Fleetmon.com.

© GD Herbst 2021

GD Herbst 20210 15

WORLD TRADES VOLUME FOR GOODS FROM 2015 TO THE END OF 2022

Index, 2015=100

125 120 115 110 105 100

95 90

Quelle: WTO and UNCTAD for trade volume data; WTO for forecasts.

DOUBLE-DIGIT GROWTH IN WORLD TRADE

2015 2016 2017

2018

2019 2020 2021 2022

TREND 2011-2019 PREVIOUS FORECAST

MERCHANDISE TRADE VOLUME

CURRENT FORECAST

Data from the WTO – World Trade Organisation suggests a recovery in world trade this year. Growth during the current year is put at 10.8 percent. In the spring, the WTO still put it at eight percent. Next year should also see growth. Estimates from WTO experts still see this as 4.7 percent.

16 | Port of Hamburg Magazine | December 2021

w

V u ß

f n r

t

I

h r e

ä ü

n m