Hamburg’s green fleet

Hamburg’s municipal fleet, one of Hamburg Port Authority’s subsidiaries, is making great strides towards sustainable shipping.

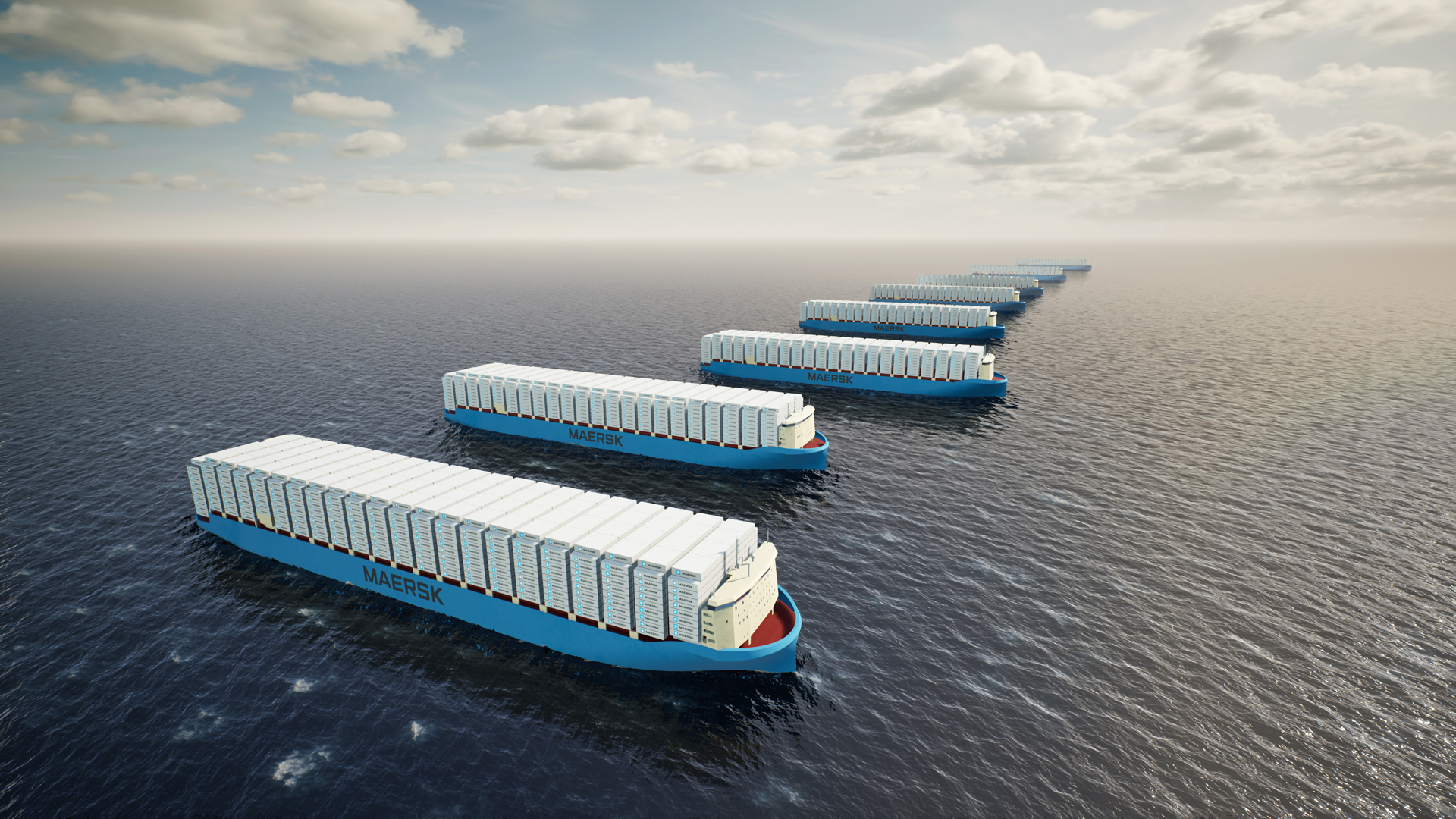

Maersk shipping line, to which Hamburg Süd also belongs, has set itself the task of being completely climate-neutral by 2040 – both in shipping and also in land pre-/post-voyage runs and in airfreight. “That is ambitious, but we are already investing massively in this now, among other things in in e-trucks,” says Rainer Horn, spokesman for Maersk and Hamburg Süd. Most emissions very clearly occur in its ocean business, and the group is here going for such scalable, climate-neutral fuels as e-methanol.

Maersk has already ordered 13 ships that can be operated with e-methanol, i.e., a feeder vessel that will be in operation from 2023, plus twelve 16,000-TEU ships that will enter service from 2024. “Along with six partners, we have decided to build the corresponding e-methanol production facilities. That will provide us with annual access to 730,000 tons,” he adds. This may suffice for the 13 upcoming vessels and a few more newbuilds, but further projects must follow, so as to also guarantee future ships a supply of climate-neutral fuels. All further newbuilds to be ordered in future by the group should be suitable for climate-neutral fuels.

Even now, the shipping line is already using bio-fuels, based for example on used cooking oil. “We have a rapidly growing number of customers, often very large – both for Maersk and also Hamburg Süd and Sealand – that against a low surcharge are having their cargo transported using our additional EcoDelivery product,” states Horn. In the process, a sufficient quantity of green fuel is bunkered into a Maersk vessel in the network. This corresponds to the fuel consumption of the customer’s containers. In liner shipping, that can readily be calculated. At sea, transport of these containers is therefore climate- neutral. In addition, the group is working on being able to be climate-neutral when offering the remaining elements of the supply chain.

One disadvantage is that the biofuels from used cooking oil are not scalable, all the more so since Maersk does not purchase these from food sources, but from waste flows. “We currently regard e-methanol as the best and most rapidly feasible alternative to the EcoDelivery fuels,” explains the spokesman. The energy required for production, and here primarily for electrolysis, is derived from solar and wind power. Ammonia and other synthetic fuels are alternatives already being intensively researched by the company along with partners. Already a member of the SteelZero-Initiative, Maersk aims to be a role model in sourcing climate-neutral steel for ships and containers.

Maersk has worked out a comprehensive ESG agenda for all its actions. This includes site analyses, firm targets and schedules. Along with ‘E’ for Environment, the priority areas S-Social and G-Governance are embedded here. The social area includes diversity, fairness and inclusion, while along with human and labour rights, governance – or corporate management – also covers sustainable purchasing, for example