Trades fairs remain the key to success

Port of Hamburg Marketing organized two joint stands at two world-renowned trade fairs at the same time. ...

POHM: Mr. Stamer, you are the father of the Kiel Trade Indicator that uses worldwide containership movements to assess the trade flows of 75 countries and regions. How did you come up with this idea?

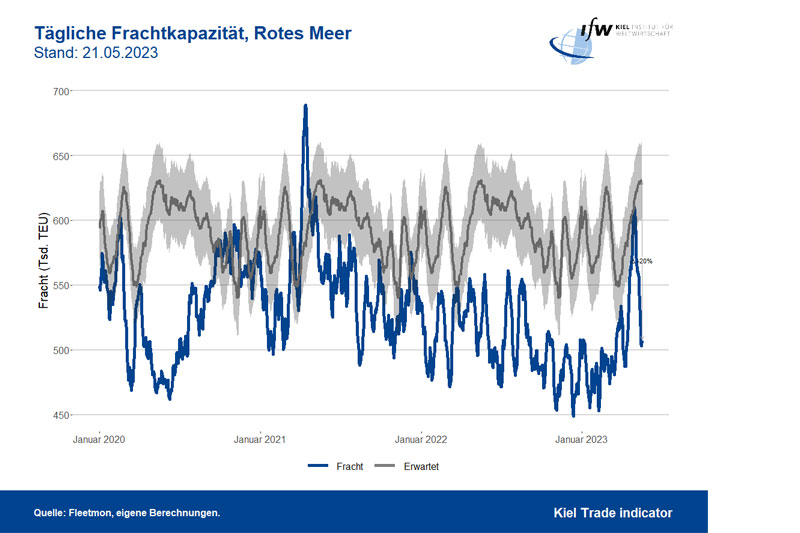

Vincent Stamer: You will hardly believe this, but I developed the Indicator as part of my doctoral thesis. The idea in the first place was to use ship data to evaluate trade flows between Asia and Europe. The Red Sea is a central geographical point for doing so. At the beginning, I used the MarineTraffic app that shows all ships worldwide in real-time. In the Red Sea I counted these manually. For the second step I then had assistance from additional scientific aides. Only at the third stage did I succeed in automating all this and applying it to all the world’s oceans.

What does this mean for the Trade Indicator?

The AIS position allows every container vessel to be clearly identified. We now take account of all containerships with a length of over 80 metres. These total around 6,000. Every day, we receive a position and port call details from these.

What can then be deduced from these movements?

During the Corona pandemic, for instance, we were able to clearly monitor the repercussions of the various lockdowns. In January and February, 2020 the first of these occurred in China. This led to a decline in Chinese exports. In March and April, these recovered briefly. Yet ever since, both imports and exports in the Red Sea have remained at a very low level, or around 10-15 percent below the anticipated figure. The overall weakness could subsequently be explained by lower European exports to Asia. By contrast, some imports to Europe increased.

Does that suggest a certain dependency on China?

It suggests at least the significance of trade with China. Yet at this stage, not only Europe is affected. The world economy also profited from the fact that China continued to produce after the first lockdown. That means the reverse conclusion that had we only traded with ourselves, the world economic crisis would have been worse. Although trade flows continued to be very low, in this case we even profited from Chinese imports, although trade flows remained very low.

Dr. Vincent Stamer gained a BA degree at Brown University in the USA and an MA at Munich University. After work experience with Boston Consulting Group, he started to research at the Kiel Institute for the World Economy and wrote his dissertation on interaction between the container shipping network and international trade. He currently works as a scientific staffer in the Economy & Growth Research Centre, specializing in German foreign trade.

Let us stay with dependencies on China. Are these so grave, then, as many politicians assert?

As an economist, I can only confirm that. Naturally, certain dependencies exist in a few areas. Let us take electronics, for example. Should an economic conflict arise, it would actually be hard to obtain laptops in Europe, since two-thirds of these come from China.

Are there any other examples then?

Basically, it can be said that not all trade with China is bad. Christmas trees decorations are one fine example, since almost 100 percent of these come from China. Even this is of national economic value, although I would not speak of ‘dependency’ there. This only exists when we are unable as a national economy to replace a product, and one that is essential for everyday life.

Dependencies on China are also feared in the case of financial stakes. Cosco is one of the most recent examples.

I tend to see less of a dependency here. The Port of Hamburg already handles one-third of its containers with China. Should the European Union embark on a trade war with China, the problem would be different. I therefore see the whole debate about Cosco’s entry as much too agitated.

Cosco is already a major partner in the port. Won’t the trades instead tend to remain stable?

That is not necessarily so. The Port of Piraeus is an indication of how strongly Cosco is becoming committed, but not necessarily forcing others out of the market. If this also applies to Hamburg, that could be a positive impulse for the port. Cosco, for instance, could decide not to build up any liner services around the Skagerrak and instead to go for transhipment into the Baltic.

The German government is currently in the process of slightly distancing itself from the People’s Republic. Are you finding that this is having initial repercussions on companies’ sourcing strategies?

China’s economic weakness has already been interpreted in that sense by some experts. Yet in my opinion it is extraordinarily difficult to quantify this. I should be very cautious. Normally a diversification of this kind from China should be accompanied by an increase in trading volume in SE Asia and in the same technology sector. That cannot be seen to a large extent. Instead, surveys tend to indicate that two-thirds of companies are continuing to stick by China. Diversification does not mean either that companies will close their plants in China.

So it has so far been nothing more than hot air?

Even for the future, I do not anticipate that companies committed in China will close down their activities. My forecast is that in the next five or ten years this will tend to be reflected in having a very slightly smaller share in China’s growth. Investments will probably grow less and move to other countries. That will be a creeping process and one barely possible to quantify.

How can you succeed there?

We must always calculate how great trade with China would be, had we not diversified. For that, we need to be aware of the two countries’ economic growth, also that of additional countries in order to able to arrive at a contrafactual example. That is the only way of calculating how the situation would have been without the political tensions. As a scientist, I can only say that it is far too early to verify these strong tendencies.

Would India be one of the countries in which German companies will become more involved?

India could be one of the up-and-coming countries. There is much to suggest that. The potential is there. The population is well educated and speaks English and the level of wages remains low. Yet we are still seeing no investments in production. So far these have been confined to services.

What needs to happen?

First, a tipping point needs to be reached. As soon as the first concerns invest, the infrastructure will adapt. As a sequel, economic/political parameters will change and a lot will become simpler until change receives its own momentum. It remains true that India has other potential, but I don’t yet see the country as being on a par with China.

Which additional countries enter the reckoning in addition?

The diversification mentioned will at first remain in SE Asia, i.e. Malaysia, Indonesia and possibly Vietnam, although that could be politically uncertain. I should like to point out that a few years will pass until we find clear tendencies indicating that trade flows are changing.

Which factors could speed up diversification?

An escalation in the Taiwan question would be one such factor. Should it actually come to that, there will probably be no cessation of trade. Instead, I assume that penal Customs duties would arise, as in the trade ware between China and the USA. This approach would then enable European companies still to source specific cargoes.

Can anything be concluded from the conflict between the USA and China?

Trade flow suffered during the Trump presidency. A strong downturn occurred with goods of some types. Yet trade did not fall to zero. For the most part, these dues are still in force and yet the North Americans purchased a great deal in China during the corona crisis. That, incidentally, also caused the ship queues off Los Angeles.

„Container ships with a

length of 80 meters or more

are listed in the Kiel Trade

Indicator with daily position

and port calls."

What impetus would still be of importance for an economic recovery?

We should lay an additional focus on the Eurozone. If we look now at Europe as a whole, this zone is our largest trading partner, accounting for over 50 percent. This also means that as soon as the economy in Europe picks up again, Germany, especially, will notice that. So one impetus for growth could originate from Europe.

If you were to sum up, will a transformation of trade flows occur?

It is still too early for a major turnround. But I believe that we are seeing initial signs that trade with America is rising. Nor should we be losing sight of Europe. My plea is that while we should become aware of certain dependencies, not all trade with China is bad. Not every import from China leads to a dependency.

The Kiel Trade Indicator estimates the trade flows – imports and exports – of 75 countries and regions worldwide, along with world trade as whole. Individual estimates cover over 50 countries, as well as regions such as the EU, Sub-Saharan Africa, North Africa, the Middle East, and the Asian threshold countries. It is based on evaluation of ship movement data in real-time. An algorhythm programmed at Kiel Institute for the World Economy evaluated this with the assistance of AI and ‘translates’ ship movements into growth figures on the previous month, adjusted for prices and seasons.

Ship arrivals and sailings are covered for 500 ports worldwide. In addition, ship movements are analyzed in 100 sea regions, and effective load factor for containerships measured on the basis of draft. Country-port correlations enable forecasts to be made, even for countries without deepsea ports of their own.

Compared to previous early-stage indicators on trade, the Kiel Trade Indicator is available considerably earlier, is distinctly more comprehensive, is founded on a hitherto uniquely sizeable database with the help of ‘big data’ and embodies comparatively minimal statistical errors. With growing data availability the Kiel Trade Indicator learns more, so that forecast quality rises over time. (Source: ifw Kiel)