Hydrogen from Uruguay and Canada

The Port of Hamburg is playing an important part in the build-up of an international hydrogen economy. ...

The red beam behind China still runs from left to right over the whole screen page. The country heads the Top Ten partner countries in the Port of Hamburg’s seaborne transport by a wide margin. Last year, China alone accounted for 2.46 million TEU, while Singapore took third place with 423,000 TEU, and South Korea was in tenth with 186,000 TEU. At the beginning of May, Hamburg deepened the port partnership with Busan founded in 2010. With NE and SE Asia, the East Asia trade has long been a top area for Hamburg’s seaborne container transport – but in future cargo flows here could shift.

Major container shipping companies already have the shift within Asia on the radar. “We are seeing that with some companies, the geographical re-orientation starts as part of the China-plus-one strategy says Andreas Bütfering, responsible at Hapag- Lloyd in Hamburg for the Far East trade. The ‘C+1’ involves companies, not just in investing in China, but in extending their production to other countries, as Schwabmünchen-based Schöffel Sports Gear is doing.

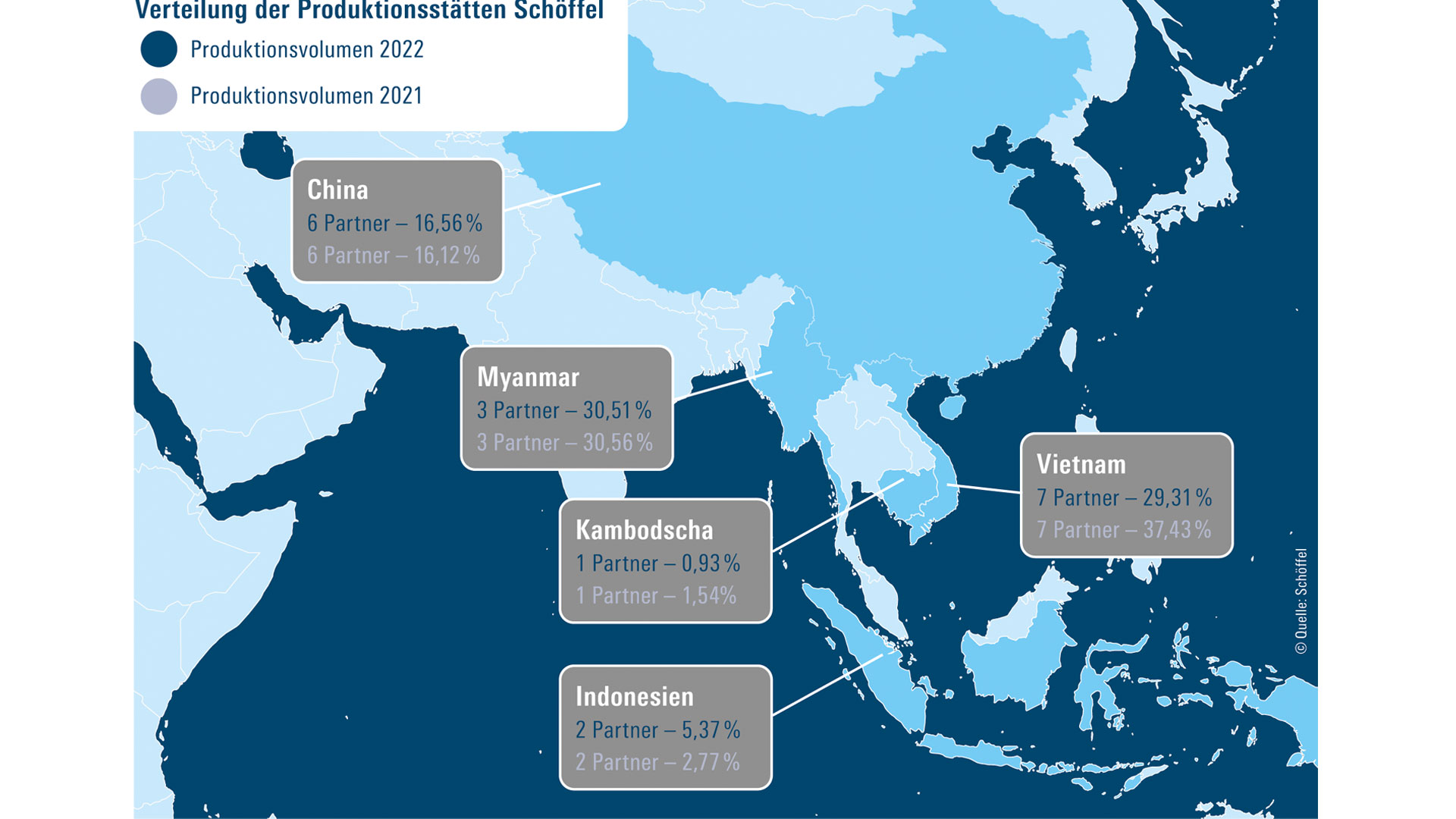

This mid-sized family company is having most of its functional, technical workwear made in Asia, since it sees ‘special expertise for high-quality textile processing and production on commercially interesting conditions settled there.’ In view of our CO2 strategy, shipborne logistics are our first choice,” says Schöffel spokeswoman Katrin Lörch. In 2022, partners from China supplied 16.56 percent of total worldwide productions, Myanmar contributed 30.51 percent, and Vietnam, 29.31 percent. According to Lörch, “there are prospects” of a reduction of manufacture in Myanmar. 5.37 percent of future world factories will be built in Indonesia, and 0.93 percent, in Cambodia.

In view of the imposing list, Walde feels that is important to state that diversification does not entail any complete retreat from China. Now as before, German companies regard China as one of the top markets. Exactly the same view is taken by Michael Bönisch, who as Managing Partner with Continuums Hong Kong has specialized in securing client-specific product from sub-contractors in Asia and ships 95 percent of his export cargoes for Europe via the Port of Hamburg. His trade clients order household goods and kitchen utensils – and for these China has developed a dominant acquisition system since the 1990s. In view of higher costs in China, full warehouse and fewer orders, Bönisch sees many trading companies reconsidering their companies supply chains.

For Anne Thiesen, Schöffel is a typical example of how companies are organizing their supply chains in Asia increasingly resiliently to reduce risks of cancellations caused by geopolitical conflicts, price peaks or material bottlenecks. She advises companies on access to the Asian market, and as a representative of the Port of Hamburg has done so for years, e.g. on establishing companies or the search of business partners in Hong Kong, South China, and SE Asia. Increasingly often, her network has the job of working out a Plan B for factories in China. “Many companies are in the process of transferring their production, primarily to Vietnam, India or Thailand,” she observes.

The trend is confirmed by Marko Walde, CEO of the German Economic Delegation in Vietnam: “Since mid- March 2022, we have assisted 20 German companies with the search for investment opportunities in Vietnam.” The C+1 strategy has gained momentum over the last three years: “The chamber in Vietnam has received over 120 enquiries from German companies wishing to settle in Vietnam.“ Most of these were related to China and “came from production facilities located there, or regional head offices.”

According to Walde, 21 manufacturers invested in Vietnam during the period mentioned – these included Beiersdorf subsidiary Tesa – self-sealants , Leonhard Kurz – thin film technology, Hartung – garden, gift and stationery items, Fischer – fixing systems, Viessmann – heating, cooling and ventilation technology, Magnetec – inductive construction elements and Ziehl-Abegg – ventilation, drive and regulation technology.

In the household goods sector Bönisch is currently seeing an ‘extremely strong shift’ to Vietnam: “The supply chains are already there, suppliers have sub-contractors there, even medium-sized companies – or the ‘Mittelstand’- are already there on the spot. In Indonesia, by contrast, production is ‘in the starting blocks,’ Bönisch currently still obtains three-quarters of his wares in China, one-fifth in Vietnam and five percent in Indonesia. “The situation shifts relatively quickly, project business has become considerably more flexible, prices are decisive,” he says. From 2024 he will adapt to “acquiring larger quantities from India”. Hitherto there have been “serious problems with raw material” for household goods, but by the end of the year two Indian conglomerates were able to offer capacities for stainless steel in the desired quality. Above all, for his US customers that could prove to be a tempting alternative.

„Major container shipping

companies already

have the shift within

Asia on the radar.“

As a production location, India is profiting from the USA–China trade war. According to a current evaluation by the online portal Statista, “currently almost the entire volume of trade between the USA – around 550 billion US dollars – and China – around 185 billion US dollars – is subject to penal and countervailing duties, although not all duties are active.” The US media group Bloomberg sees signs of a ‘reglobalization,’ because since 2018 China’s share of US imports has shrunk in favour of other Asian export nations. By March this year, Apple tripled its production capacities in India, manufacturing iPhones to the value of more than seven billion US dollars there. At the beginning of May, US technology group Cisco announced that it would be building up central production capacities in India to achieve ‘resilience of the supply chain.’ Such global shoes manufacturers as Nike, Adidas, Puma and Reebok are also pursuing their C+1 strategy on the sub-continent. Experts are assuming that other sectors will be following, in particular the retail trade. For two years now, Dirk Matter, CEO of AHK India in Düsseldorf, has been receiving ‘significantly more enquiries’ because German companies are looking for new sourcing markets. He sees potential in India primarily for such metal products as cast and forged parts, automotive components, and chemical, pharmaceutical, electrical and electronic products.

To make India an exporting country, in 2020 the government announced ‘production-linked incentive schemes’ for 14 key industries, starting with automotive parts, via battery units and textiles, to white goods. “Industrial workplaces are the answer to population growth,” says Stefan Halusa, CEO of the German- Indian Chamber of Commerce in Mumbai. With its national logistics policy, the Indian government is attempting “to make available a competitive logistics infrastructure for exporting“, for logistics costs are still twice as high as in Europe. Yet Halusa stresses that: “Owing to the shorter transport route, India enjoys a geographic advantage over China and other Asian countries.“

Thomas Heck, head of the China Business Group at chartered accountants PricewaterhouseCoopers in Frankfurt, is aware of which de-risking strategies companies are pursuing just now in China “We are hearing on the market that the great majority of companies are staying in China and continuing to invest, but mid-sized companies, especially, are also precisely scrutinizing other markets,” he says. While groups “in case of doubt can live with production ceasing for a few years in China or no dividends coming for a certain time from China, this can be of existential significance for mid-sized companies with only three or four plants worldwide. Heck mentions Singapore as the main winner, since not only are expats moving there in droves from Hong Kong and mainland China. Companies such as Evonik in chemicals and semi-conductor manufacturer Infineon are positioning themselves with Asia headquarters in the island nation.

Over 2,000 German companies are active in Singapore, according to Tim Philippi, Executive Director of the German- Singapore Chamber of Industry and Trade. over 2,000 German companies. This global finance centre is also an important production site – Philippi says that “more than 20 percent of GDP is generated by the manufacturing sector.” Like many other international companies, they use the city-state “primarily as a regional base for expanding in other SE Asian markets.” This is confirmed by Peter Dressler, Vice President Logistics for Infineon Technologies: „We have sites in Malaysia, Indonesia, Singapore, Thailand and on the Philippines. Many of our production partners are in the SE Asia regions. Singapore is an important logistics hub for us.”

37.29 million TEU crossed the quay walls last year in the Port of Singapore, the world’s second largest. By 2040, additional capacities of 65 million TEU will be created in Tuas Port to meet the growing demands of global trade.

Vietnam also possesses a state-of-the-art seaport system – Hai Phong, Ho-Chi-Minh-City, Ba Ria and Vung Tau are all on the list of the 50 ports worldwide with the greatest freight throughput. Gateway ports like Lach Huyen, Hai Phong, Cai Mep, Ba Ria and Vung Tau can handle mega-containerships. The Vietnamese Statistics Office estimates total container volume for all Vietnam’s seaports in 2022 as 25.09 million TEU – or five percent more than in the previous year. “Steep growth of the trades to China, Japan, South Korea, SE Asia and on some European routes, along with high sea-freight rates, have helped many Vietnamese shipping companies to solid turnover and profit growth,” reports Walde of the Vietnam chamber.

„Industrial jobs

are the

answer to

population growth.“

Indian seaports are profiting from private investments, e.g. for the expansion of the Container terminal in Jawaharlal Nehru Port in Mumbai, with participation from J M Baxi Ports & Logistics Ltd. (JMBPL). Since January, 35 percent von JMBPL has belonged to Hapag- Lloyd, whose CEO Rolf Habben Jansen sees India as “one of our most important growth markets.” Along with the world’s largest container port in Shanghai, six additional Chinese ports are among the Top Ten for throughput. Leo Xu as Sales & Pricing Manager South China for international forwarder Spedition A. Hartrodt, is located at the centre of the action – with Shenzhen, Guangzhou-Nansha and Hong Kong, the Greater Bay Area contains three of the world’s largest container ports. Xu is relaxed about the relocation of some labour-intensive industries such as textile and shoe manufacturing, electronic assembly and processing: “We are concentrating on other sectors that export from China, in the Greater Bay Area we still have high tech, electronics and plant construction.” In addition, Hartrodt is paying more attention to domestic trade, with some raw material needing to be shipped from China to SE Asia

Hapag-Lloyd’s Bütfering also gives the all-clear: “The Chinese share of exports will remain dominant for a long time, and from my point of view we shall need to reach the end of the decade before see significant shifts to other countries.” The red beam behind China among the Port of Hamburg’s top partner countries should remain a long one for some time.

Tel: +86 21 5386 0857

E-mail: pan.hua@hamburgshanghai.org

2/F Hamburg House, 399 Baotun Rd.

CN 200011 Shanghai

China

Tel: +91 22 66652 150

E-mail: sameeha.sule@hamburgmumbai.com

Maker Tower „E“, 1st Floor, Cuffe Parade

400005 Mumbai

India

Tel: +49 40 37709 173

E-mail: gurries@hafen-hamburg.de

Hafen Hamburg Marketing

Pickhuben 6

20457 Hamburg