- Hamburg logistics market sees volume growth of 9%

- Hamburg South the region with the highest take-up at 49%

- Five top deals in excess of 20,000 sqm

- Still no logistics boxes available in the size category of 50,000 sqm and larger

- Prime rents approach the EUR 6.00/sqm threshold

- Port of Hamburg almost fully let

- Forecast for 2019: Take-up could decline due to shortage in supply (up to 18%)

As forecasted by Realogis after the first half of 2018, the Hamburg logistics market could outperform previous year’s results. Take-up by all market participants amounted to 490,000 sqm in 2018, an increase of 9% compared with 2017 (450,000 sqm). This represents the third-highest figure in the past five years after the record figures registered in 2016 (610,000 sqm) and 2015 (540,000 sqm) and is just below the five-year average (512,000 sqm).

“Total take-up would have been considerably higher if there had been more available space,” commented Jörg Lojewski, Managing Director of the market-leading logistics expert Realogis Immobilien Hamburg GmbH, which itself brokered around 100,000 sqm or one-fifth of the total take-up in 2018. “Unfortunately, the extremely high level of demand – particularly for logistics properties with high suitability for third-party use – cannot be met due to the lack of product availability. Furthermore, there are very few plots still in stock for development,” Jörg Lojewski added.

Take-up by region Hamburg South defended its leading position in terms of take-up also in 2018 , accounting for an impressive 49% of the overall figure (240,100 sqm) at the end the year. Four of the five biggest deals were concluded in the region around the Port of Hamburg and Harburg. The East region took second place at 34% (166,600 sqm).

Relevant deals in 2018 - nord logistic in the Hamburg district of Altenwerder/Port: 29,000 sqm (Expansion)

- BOR Handelslogistik in the Hamburg district of Waltershof/Port: 29,000 sqm (Expansion)

- IN TIME Express Logistik in Buchholz i.d.N./Hamburg South: 28,000 sqm (Owner-occupier expansion)

- Getriebebau Nord in Bargteheide/Hamburg East: 27,000 sqm (Expansion)

- Kühne + Nagel in the Hamburg district of Moorburg/Por: 22,000 sqm (Expansion)

Take-up by size categoryIn 2018, the Hamburg logistics market was particularly characterised by deals in the size category of 10,000 sqm and above (34%, 166,600 sqm). While no deals in excess of 20,000 sqm were concluded in 2017, Realogis registered no fewer than five top deals last year.

Smaller units up to 3,000 sqm were well represented once again, accounting for 30% of take-up (147,000 sqm). Despite high demand, limited availability in the medium size categories resulted in take-up of 16% (3,001 to 5,000 sqm) and 20% (5,001 to 10,000 sqm) respectively.

Take-up by sectorLogistics has been the leading sector in terms of take-up for a number of years. “In 2018, it accounted for no less than 294,000 sqm or 60% of total take-up. This represents growth of 17%, signifying a record year for the Hamburg logistics market,” commented Irina Lysenko, research analyst at the Realogis Group. As many companies still want to be close to the container terminals, Realogis expects logistics to remain the sector with the highest take-up in 2019.

Although retail defended its second place, it accounted for just 24% (117,600 sqm) of total take-up, a quarter less than in the previous year (157,500 sqm). Production companies saw lower take-up of just 9% (44,100 sqm) in 2018 compared with between 14% and 16% in the past four years.

Space in the size category of 50,000 sqm and above, which is interesting for e-commerce in the northernmost of Germany’s top seven logistics markets in particular, remains unavailable. “There are no existing or planned logistics boxes of this size,” noted Jörg Lojewski.

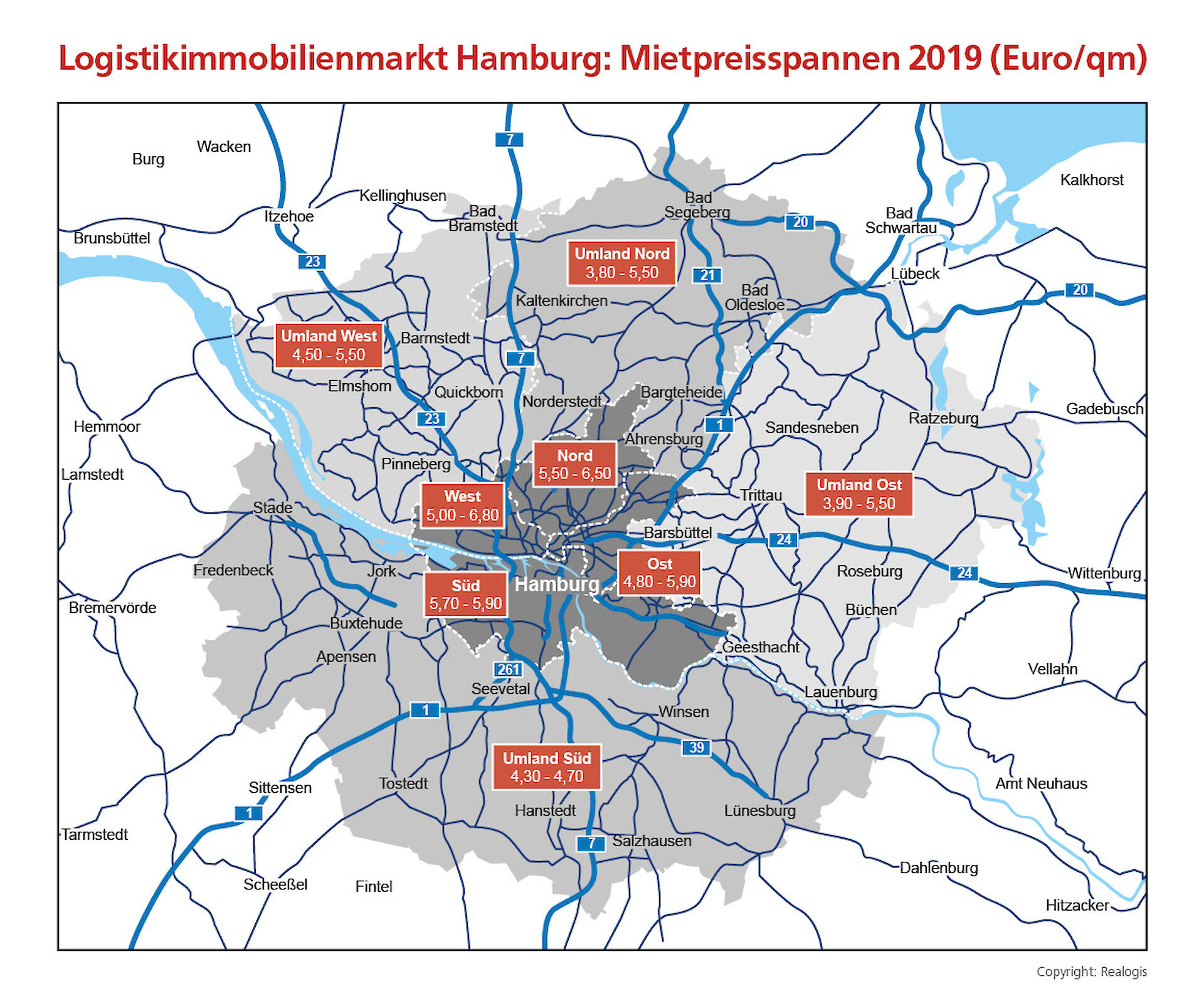

Rising rents Having remained stable at EUR 5.70/sqm for the past four years, prime rents on the Hamburg logistics market rose to EUR 5.90/sqm in 2018 (+3.5%), thereby approaching the EUR 6.00/sqm threshold in 2018 for the first time. Average rents have also increased since 2016 and now amount to EUR 4.80/sqm (+4%).

Outlook for 2019No new development activity is possible in the Port of Hamburg due to the lack of available sites. This market segment will also be fully let for the first time in Q2/2019. Where the Hamburg logistics market does still have sites available for development, new logistics space will also be realised as multi-storey buildings in the future. One example is provided by the developer Four Parx, which is constructing around 100,000 sqm of logistics space near the Port in the Hamburg district of Wilhelmsburg; this will be the first facility of its kind to stretch over two floors.

Given this scenario, it is no surprise that prime rents will exceed EUR 6.00/sqm for the first time in 2019.

As the deepening of the Elbe River has finally been approved following years of court proceedings, the latest generation of container ships will also be able to access the Port of Hamburg in the future, leading to growth in container turnover. Jörg Lojewski: “Demand will remain high in 2019. However, the low availability of space means we expect total take-up to decline to between 400,000 and 430,000 sqm. This would represent a reduction of between 12% and 18% compared with 2018.”

Greater Hamburg market area Realogis defines as a sub-market the relevant, available warehouse, logistics and production space in the Hamburg region and along the A1 motorway (Lübeck – Bremen), the A7 (Hanover – Flensburg) and the A39 from “Maschener Kreuz” within a radius of approx. 50 km.

Graphics Graphics can be printed free of charge citing the source: “Realogis – www.realogis.de”